OMERS Generates $5.6 billion in Investment Income in 2023

OMERS, the defined benefit pension plan for broader municipal sector employees in the province of Ontario, generated a 2023 investment return of 4.6%, or $5.6 billion, net of expenses. Over the past 10 years, OMERS has averaged an annual investment return of 7.3%, net of expenses, adding $66.4 billion to the Plan. Net assets at December 31, 2023, were $128.6 billion, up from $124.2 billion in 2022, and the Plan reported a smoothed funded status of 97%, up from 95% last year.

“We are investors for the long term for the benefit of our members and their families. Our focus at OMERS remains on our ability to see through economic cycles. I am extremely pleased that in the past three years, coming out of the pandemic, our extraordinary global team has earned an average annual net return of 8.0%, a track record that stands up by any objective measure. Our 10-year result speaks to our ability to invest through turbulent times while continuing to deliver for our members,” said Blake Hutcheson, OMERS President and Chief Executive Officer. "These returns enable us to keep the pension promise, paying pensions on time and as planned, as we have done consistently since our creation as a Plan in 1962.”

“As we look ahead to 2024, higher interest rates are creating opportunities for us to deploy capital into fixed income to improve future returns, consistent with our new, more diversified strategic asset mix. We are confident in our ability to generate long-term returns that will build up the Plan’s assets given the high quality of our investment portfolio and the strategies that underpin it. I am very pleased with the way we are positioned for the future.”

“Returns in 2023 reflected a major divergence between the performance of public and private assets,” said Jonathan Simmons, OMERS Chief Financial and Strategy Officer. “Public equities and fixed income had a strong year and fixed income assets benefitted from higher interest rates. Returns from private asset strategies were held back by the increased cost of debt, increased operating costs, and anticipated slower economic growth, all of which are affecting private market investors worldwide.”

“Through a combination of pension payments, investment activities and our operations, OMERS impacts more than 1 in every 11 Ontario households,” said Mr. Hutcheson. “Our plan is contributing $13.7 billion annually to Ontario’s GDP and supporting more than 143,000 jobs provincewide. We have significant investments in Ontario with assets that include Bruce Power and Yorkdale Shopping Centre. We are proud to make a meaningful contribution to the economic and social strength of this great province.”

“With a promise to deliver for our members over the long term, our global teams are relentlessly focused on building a sustainable, affordable and meaningful plan that will continue to provide security in retirement for generations of members to come.”

OMERS remains highly rated by four credit rating agencies, including two ‘AAA’ ratings.

Media Contact:

Don Peat

dpeat@omers.com

416.417.7385

About OMERS

OMERS is a jointly sponsored, defined benefit pension plan, with 1,000 participating employers ranging from large cities to local agencies, and over 600,000 active, deferred and retired members. Our members include union and non-union employees of municipalities, school boards, local boards, transit systems, electrical utilities, emergency services and children’s aid societies across Ontario. OMERS teams work in Toronto, London, New York, Amsterdam, Luxembourg, Singapore, Sydney and other major cities across North America and Europe – serving members and employers, and originating and managing a diversified portfolio of high-quality investments in bonds, public and private credit, public and private equity, infrastructure and real estate.

2023 | |

|---|---|

Public Investments | |

Bonds | 5.8% |

Credit | 8.3% |

Public Equities | 10.4% |

| |

Private Equities | 3.9% |

Infrastructure | 5.5% |

Real Estate | -7.2% |

Total Net Return | 4.6% |

2022 | |

|---|---|

Public Investments | |

Bonds | -3.8% |

Credit | 3.4% |

Public Equities | -11.9% |

| |

Private Equities | 13.7% |

Infrastructure | 12.5% |

Real Estate | 13.6% |

Total Net Return | 4.2% |

Net Investment Returns for the years ended December 31,

2023 | 2022 | |

|---|---|---|

Public Investments | ||

Bonds | 5.8% | -3.8% |

Credit | 8.3% | 3.4% |

Public Equities | 10.4% | -11.9% |

| ||

Private Equities | 3.9% | 13.7% |

Infrastructure | 5.5% | 12.5% |

Real Estate | -7.2% | 13.6% |

Total Net Return | 4.6% | 4.2% |

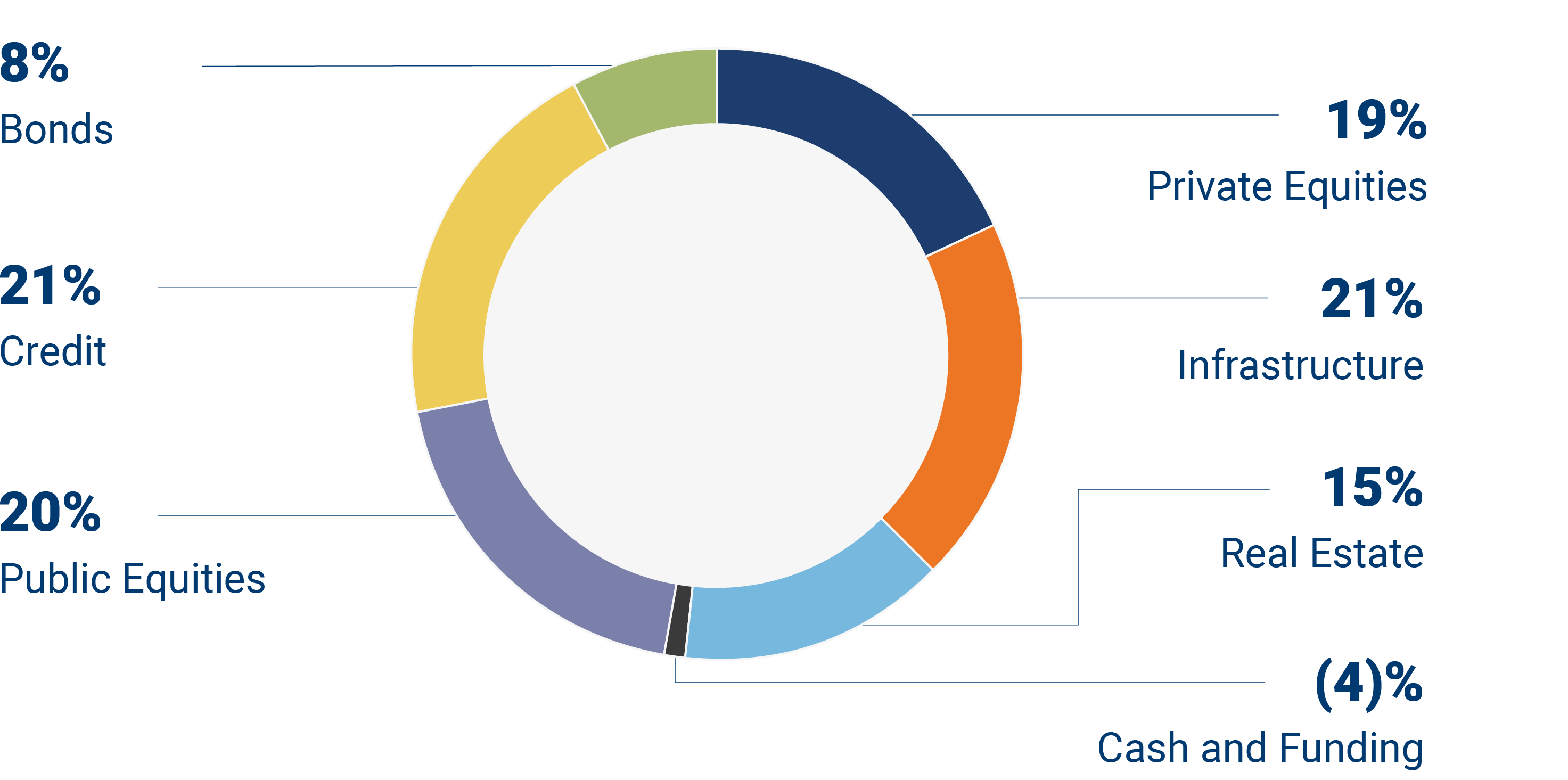

2023 Asset Mix

2023 Highlights

By the numbers

2023 investment return of 4.6%, or $5.6 billion, net of expenses

$128.6 billion in net assets

A 3-year net return of 8.0%, and a 10-year net return of 7.3%

612,533 OMERS members including 44,462 new non-full-time employees

97% smoothed funded ratio – up from 95% in 2022

3.75% real discount rate

$34 billion invested in Canadian assets

$13.7 billion contributed by OMERS to Ontario’s GDP

143,200 jobs supported by OMERS in Ontario

96% all-time-high OMERS member service satisfaction

94% of employees are proud to work for OMERS and Oxford (+6 points above best-in-class)

Transactions in 2023

In 2023, OMERS deployed $11.5 billion in capital, making investments that will contribute to our long-term ability to pay pensions for our members.

In addition to the transactions we reported in August with our 2023 Mid-year Update, we made the following announcements in the latter part of the year.

Maple Leaf Sports & Entertainment

OMERS invested US$400 million for an indirect stake in MLSE. MLSE is the parent company of sports teams including the National Hockey League’s Toronto Maple Leafs, the National Basketball Association’s Toronto Raptors, Major League Soccer’s Toronto FC, and the Canadian Football League’s Toronto Argonauts.

Redwood Materials

OMERS participated in Redwood Materials' over US$1 billion investment round. This funding will help build Redwood’s capacity, expanding the domestic battery supply chain and allowing customers to purchase battery materials made in the US for the first time.