Welcome to OMERS!

As a non-full-time (NFT) employee of an OMERS employer, you are eligible to elect to join the OMERS Plan.

While for some of you, retirement can seem like a long way away, joining the OMERS Plan will set you up for success when the day comes. And time flies!

As one of Canada’s largest defined benefit pension plans, OMERS is dedicated to providing retirement security to more than half a million public service and other employees in Ontario. Starting in 2023, it’s going to be easier for non-full-time employees, like you, to join the OMERS Plan and receive our member benefits, including:

income for life

employer contributions towards your pension

early retirement options

survivor benefits

disability benefits

a lower taxable income

The OMERS story

Helping to ensure financial security in retirement for over half a million public service and other employees in Ontario

The OMERS Plan is a defined benefit pension plan, which means you can expect a predictable monthly income for the rest of your life after you retire and start your OMERS Plan pension.

The more years of credited service you have in the OMERS Plan, the larger your pension benefit will be.

At a high level, here’s how it works:

Based on your earnings, a percentage will come off your paycheque from each pay period and go towards your pension.

Your employer will match your contributions and OMERS investments will also fund a portion.

The amount you contribute does not determine how much of a pension benefit you will receive when you retire. That’s determined by our pension formula.

Find out more about Your contributions below.

Once you become an OMERS member, you can register for myOMERS, an online resource available 24/7 with various self-serve tools. Every year, a report is posted to your myOMERS account outlining how much you’ve contributed as part of your Annual Pension Statement.

What our members are saying

OMERS and other defined benefit pension plans help Canadians retire with peace of mind and add billions of dollars to the Canadian economy. You can learn more about this in two 2021 reports developed for OMERS by the Canadian Centre for Economic Analysis (CANCEA), an independent socioeconomic research firm, that illustrate the social value and economic contribution generated across Ontario by pension plans such as OMERS.

“When I retire, I can look back and say I set myself up for success as much as I could. I have no regrets. And I’m looking forward to it.”

– Zoe Vanderdolan, human resources specialist, Ontario Secondary School Teachers’ Federation

“My OMERS pension has enabled me to do lots of things. I am able to contribute to others and to help them as well.”

– Denise Campbell, retired, Peterborough Housing Corporation

Don’t wait to explore your savings opportunities

Putting money away today will help you retire with peace of mind

About the pension formula

There are two components of the OMERS Plan defined benefit formula: the lifetime pension and the bridge benefit (see the “Read more” section below for the details). Your lifetime pension is paid to you after you retire and for as long as you live.

The bridge benefit is designed to be paid until age 65, which is the age most folks begin receiving payments from the Canada Pension Plan, also referred to as CPP. Once you turn 65, the bridge stops being paid. From 65 onward, you continue receiving your lifetime pension.

The formula we use to calculate your pension takes into account your best five consecutive years of contributory earnings (“best five” earnings) and total credited service for your OMERS membership.

Your “best five” earnings are the annual average of the 60 consecutive months during which your contributory earnings were at their highest. Remember that contributory earnings do not include any overtime pay and most lump-sum payments are also excluded. Contributory earnings might include earnings from a period of service that was transferred from another registered pension plan.

To calculate your lifetime and bridge benefit, 2% is multiplied by your years of credited service and by your “best five” earnings. If you choose to retire early, your OMERS pension may be reduced to reflect that it will be paid to you for longer.

As mentioned earlier, the OMERS bridge benefit stops after you turn 65. The formula for calculating the bridge benefit is 0.675% multiplied by your credited service and by the lesser of your “best five” earnings and the average YMPE.

The YMPE is the year’s maximum pensionable earnings, an earnings figure used in the CPP. This is also sometimes called the CPP limit. Your average YMPE is the average of the YMPE in the year you terminate employment with your employer and the YMPEs of the four preceding calendar years.

Annualized Contributory Earnings

For NFT members, we look at annualized contributory earnings when determining your “best five” earnings. In other words, for employees who do not work a full-time schedule or who do not work 12 months in each year, our calculation is not based on the contributory earnings that you received and made contributions on. Instead, the OMERS Plan formula annualizes these contributory earnings based on the full-time equivalent of what your contributory earnings would have been if you worked full time. See our Pension Calculation Examples for high-level illustrations of how earnings are annualized.

More about your options

To learn more about what happens when you leave your OMERS employer, if you take a leave, early retirement options and more, refer to the Member Handbook.

Summary

Your annual lifetime pension from age 65 is calculated as follows:

Your OMERS Plan lifetime pension plus bridge benefit to age 65 (2% x credited service (years) x “best five” earnings) less OMERS bridge benefit at age 65 (0.675% x credited service (years) x lesser of “best five” earnings or AYMPE (five-year average of the YMPE).

![NFT: Formula [2% x credited service (years) x "best five earnings"] - [0.675% x credited service (years) x lesser of "best five" earnings or AYMPE*] = OMERS lifetime pension from age 65

*Five-year average of the year's maximum pensionable earnings (YMPE)](http://images.ctfassets.net/iifcbkds7nke/3sZz3gBLmrXmcbZr7vWag7/91f4dddb27f04c9f88747f3832805ead/Pension_formula.png)

Meet Jane

Let’s put the formula into action and look at an example of a pension calculation for illustrative purposes.

Jane works for a school board for 10 months of the year. She can retire early in the year 2048 with an unreduced pension at age 55. She has 25 years of credited service + 5 years of eligible service. Her “best five” earnings are $50,000 and are based on the following:

Year

Actual Earnings

Annualized Earnings

2043

$40,000

$48,000

2044

$40,833

$49,000

2045

$41,667

$50,000

2046

$42,500

$51,000

2047

$43,333

$52,000

"Best Five"

$41,667

$50,000

When we calculate your pension, we look at annualized, pensionable earnings. For employees who do not work a full-time schedule or who do not work 12 months in each year, our calculation is not based on the earnings you would see on your pay statement or your T4, but rather on “annualized earnings” (i.e., the full-time equivalent of your earnings based on your pay rate).

Jane's lifetime pension calculation:

![NFT: Jane example pension formula [2% x 25 years x "$50,000" = $25,000] - [0.675% x 25 years x $50,000 = $8437.50] = $16,562.50](http://images.ctfassets.net/iifcbkds7nke/5PmEevUffi4ix1XYjxSoo0/600461465913a1a2a7452a3945216024/Pension_example.png)

Your contributions

Your contributory earnings are your regular and recurring earnings in each pay period, excluding additional amounts such as overtime pay and most one-time and lump-sum payments.

You contribute a percentage of your contributory earnings in each pay period to the OMERS Plan through automatic deductions and your OMERS employer will also contribute an equal amount. These contributions will fund a portion of your OMERS pension. Investment earnings of the OMERS Fund will contribute the balance. Learn more about contributions per pay period.

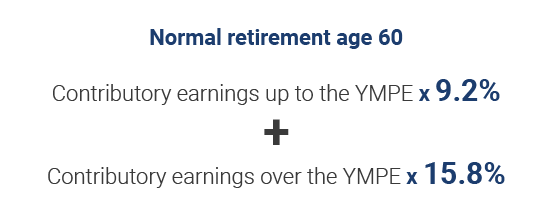

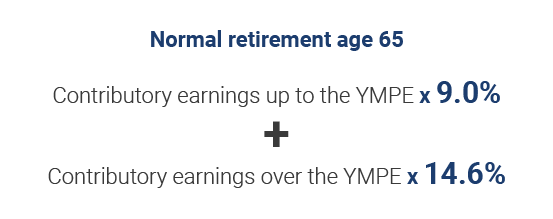

The current contribution rates are as follows and depend on your normal retirement age (NRA). Most OMERS members have an NRA of 65 but some police and firefighters have an NRA of 60. Your NRA is the age you can retire with an unreduced pension. But there are ways you can retire up to 10 years before your NRA. To learn more about retiring before your NRA, refer to Planning for retirement.

Features of the OMERS Plan

Key elements of the OMERS Plan provide security and peace of mind during your career and in retirement

Income for life

The OMERS Plan is a defined benefit pension plan, which means members can expect a predictable monthly income in retirement. Together with government benefits and savings, an OMERS pension can grow into an important financial asset and play a key role in financial and retirement security.

Member and employer contributions

You will contribute a percentage of your earnings to help pay for your future pension. Your employer will also contribute an equal amount. These contributions will fund a portion of your pension. OMERS investment earnings fund the balance.

Early retirement options

You can elect and begin to receive an early retirement pension on/after your early retirement birthday. For most members who have a normal retirement age of 65, this is their 55th birthday. For members with a normal retirement age of 60, this is their 50th birthday.

Survivor benefits

Survivor benefits are a key feature of the OMERS Plan, and part of our commitment to providing a secure future for members and their survivors. Survivor benefits and options available depend on whether death occurs before or after retirement.

Disability protection

Disability benefits are an important feature of the OMERS Plan. In the event that a member is unable to work, they may be eligible for disability benefits.

How OMERS invests in the Plan

Your pension is funded equally by contributions from you and your employer along with the investment earnings of the OMERS Fund. To learn more about OMERS investments and our vision for the future, check out our Investing page.

Stable income in retirement

The OMERS Plan helps to provide financial stability in retirement. For as long as you live after you retire, you will receive your OMERS pension.

More details

Read about all the features of the OMERS Plan in the OMERS Member Handbook.

Your enrolment guide

After you receive an offer of enrolment package from your employer or from OMERS in the mail, which will include the OMERS Member Handbook and some important paperwork, we recommend taking some time to read the Member Handbook in full and learn all the features of the OMERS Plan.

As a non-full-time employee, if your enrolment with OMERS is voluntary, you have options. You may choose to join the OMERS Plan, choose NOT to join or join at a later date. This is an important choice to consider as joining the Plan may not be right for you.

In the enrolment package, there is an Offer of OMERS Membership form that you must complete to indicate your election to enrol or not to enrol in the OMERS Plan. Once you complete this form, it should be sent back to your employer. Not sure who to send it to in your organization? Get in touch with your employer and they will point you to the right person. Your employer will save a copy of your election.

If you choose to enrol and complete your Offer of OMERS Membership, your employer will enrol you in the OMERS Plan and you will receive a welcome package from OMERS, which will contain a unique seven-digit reference number to register for your myOMERS account.

Enrolment in the OMERS Plan generally takes effect in your employer’s next available pay period after your election is received. Your enrolment date can be no later than the end of the month following the month in which your election is received.

If you choose not to enrol now, you have the option to enrol later as long as you’re employed by an OMERS employer. If you decide to enrol later, you will need to get in touch with your employer.

Remember! Once you become an OMERS member, you can register for myOMERS, an online resource and portal available 24/7 with various self-serve tools. Every year, your Annual Pension Statement is posted to your myOMERS account containing important information about your OMERS Plan benefit, including how much you’ve contributed.

Want to learn more?

Register for an upcoming webinar with a member of our Pension Education & Relationship Management team to learn more about the OMERS Plan.

Have questions?

Call the Member Experience Contact Centre to have your questions answered by phone.

Monday to Friday, 8:00 a.m. – 5:00 p.m.

+1 416.369.2445 or +1 855.669.2445

Enrol today

Send your completed Offer of OMERS Membership form to your employer today. From there, your employer will enrol you in the OMERS Plan and you can expect to receive a welcome package from OMERS.