4.6%

Net return

A jointly sponsored, defined benefit,with over 1,000 participating employers ranging from large cities to local agencies and more than 600,000 active, deferred and retired members. Our members include union and non-union employees of municipalities, school boards, local boards, transit systems, electrical utilities, emergency services and children’s aid societies across Ontario. OMERS teams work in Toronto, London, New York, Amsterdam, Luxembourg, Singapore, Sydney and other major cities across North America and Europe – serving members and employers and originating and managing a diversified portfolio of high-quality investments in bonds, public and private credit, public and private equity, infrastructure and real estate. The benefits OMERS provides are funded equally from active members’ and their employers’combined with investment income. We expect that the majority of future benefit payments for today’s active members will be funded by investment returns. OMERS actively seeks out opportunities to engage with decision-makers to advocate for the advantages of the jointly sponsored, defined benefit pension model.

As a defined benefit pension plan, OMERS provides retirement income for life, based on earnings and years of service. Valuable features of the Plan include:

Security of regular monthly income;

A professionally invested portfolio;

Additional benefits that include inflation protection, a bridge benefit, survivor and disability benefits.

For more information on the benefits of being an OMERS member, please visit the Members section.

4.6%

Net return

$5.6B

Net return

97%

Funded status (smoothed)

3.75%

Real discount rate

612,533

Total number of members

$6.1B

Total pension benefits paid in 2023

$31,953

Average annual pension for members retiring in 2023

96%

Member service satisfaction

$29,666

Average annual pension overall

82%

Employee engagement

- Blake Hutcheson, President and CEO, OMERS Administration Corporation

($ billions)

For more than 60 years, OMERS has been proud to provide secure lifetime defined benefit pensions to members who serve our communities across Ontario.

We entered 2023 following two years of high market volatility in the aftermath of the COVID-19 pandemic during which our OMERS team delivered what would emerge, in hindsight, to be industry-leading results. These returns have helped the Plan absorb the negative impact of decades high inflation on our liabilities, buffering our members from volatility.

Net assets at December 31, 2023, were $128.6 billion, up from $124.2 billion in 2022, and the Plan reported a smoothed funded status of 97%, up from 95% last year.

Looking back, OMERS has earned a 10-year average annual return of 7.3%, achieving our long-term benchmark and adding $66.4 billion to the Plan.

We are confident in our ability to generate long-term returns that will build up the Plan’s assets, given the high quality of our investment portfolio and the strategies that underpin it. The outlook for future returns has brightened due to the better interest rate environment and due to active shifts in our asset mix.

While we continue to work to ensure that the Plan is sustainable, affordable and meaningful for generations to come, our global team has also been focused on advancing our sustainable investing priorities, ensuring that our members were served exceptionally well, and continuing to provide a workplace that would attract and retain the high-calibre team who are charged with delivering on their mandates in service of more than 600,000 members.

Our portfolio is strategically invested in markets around the world to take advantage of opportunities to earn returns that will pay pensions for generations to come, and some members have asked about our investments in our home country. While our team and our perspective are global, we are deeply proud of our Canadian roots and we have dedicated part of this report to the investments we have here.

Approximately one quarter of our investments are in Canada, and research on the Ontario economy confirms that our investment activities here, combined with the impact of pension benefits and our operations, contribute $13.7 billion in provincial GDP. We look forward to exploring further investment opportunities that align with our strategy as they arise.

We thank OMERS members and employers for the confidence they continue to bestow on us. As we did in 2023, we will work hard every day to earn their trust and deliver a pension plan that is sustainable, affordable and meaningful.

1. Investment performance - In 2023, OMERS earned a net return of 4.6%. Performance diverged between public assets, which had a strong year, and private investments, which were held back by the increased cost of debt, increased operating costs anticipated and slower economic growth, all of which are affecting private market investors worldwide.

2. Plan funding and the conclusion of Plan risk assessment - The funded status of the Plan has improved significantly in the last decade. The SC Board concluded a review of long-term Plan sustainability in 2023. No sustainability-related changes to benefits or contribution rates were made. The Board confirmed the need to continue strengthening the Plan’s funding and building reserves as the Plan matures.

3. Launch of the OMERS Climate Action Plan - We launched our Climate Action Plan (CAP), outlining our overall approach and the actions we are taking to manage risk and realize opportunities toward achieving net zero carbon emissions in our portfolio and operations by 2050.

4. Exceptionally strong member

service - Member service

satisfaction is a record-high 96%,

even as we welcomed almost

45,000 new, non-full-time members

into the Plan, and modernized a

number of key processes.

5. Better than best-in-class employee

pride and engagement - OMERS

employees are deeply committed to

serving our members and proud of

the work they do on members’

behalf.

Returns in 2023 reflected a major divergence between the performance of public and private assets. Public equities and fixed income had a strong year in an environment where stock market indices rose significantly, and fixed income assets benefitted from higher interest rates. Returns from private asset strategies were held back by the increased cost of debt, increased operating costs, and anticipated slower economic growth, all of which are affecting private market investors worldwide.

In that context, OMERS investments earned a 2023 return of 4.6%, net of expenses, or $5.6 billion in net investment income. Public equities, credit and bond investments earned 9.0% collectively for the year, and infrastructure, private equity and real estate together earned 1.2% for 2023. Foreign currency movements also detracted from our return by about 1.2%, as the U.S. dollar weakened relative to the Canadian dollar.

Weaker returns from private equity and real estate were the primary reason that OMERS annual return of 4.6% did not meet our benchmark of 7.0%, established at the beginning of the year.

Further discussion on Plan performance can be found in the Management’s Discussion & Analysis (MD&A) section of the Annual Report.

In August of 2023, OMERS approved a new long-term strategic target asset mix to ensure that our portfolio remains well-suited to capture the opportunities created by the shift to a higher interest rate environment. This new target asset mix includes greater allocations to fixed income investments and is expected to deliver similar returns as in the past, but with lower volatility.

We continue to be confident in our ability to generate long-term returns that will build up the Plan’s assets, given the high quality of our investment portfolio and the strategies that underpin it.

Between March 2022 and September 2023, in an effort to tackle rising inflation levels, the Bank of Canada raised the overnight interest rate 10 times, from 0.25% to 5.0%. The rise in interest rates created more attractive opportunities for typically safer fixed income assets.

- Tiff Macklem, Governor, Bank of Canada, May 2023

In 2023, the Primary Plan’s smoothed funded ratio improved by 2%, and is measured at 97%, using the same discount rate we have used since 2021.

Over the past two years, the Plan has absorbed the negative impact of decades-high inflation, which arose in the aftermath of the COVID-19 pandemic. This high inflation boosted the present value of future pension payments by over $5 billion. In 2023, the smoothed funded ratio returned to the level we maintained from 2019 to 2021, before the inflation-induced dip of 2022.

The fair value funded ratio declined to 94%, compared to 95% last year, because this year our assets grew at a lower rate than our liabilities. Refer to the MD&A for a full explanation.

2014 | |

|---|---|

Real Discount Rate | 4.25% |

Long-Term Inflation Assumption | 2.25% |

Nominal Discount Rate | 6.50% |

2015 | |

|---|---|

Real Discount Rate | 4.25% |

Long-Term Inflation Assumption | 2.00% |

Nominal Discount Rate | 6.25% |

2016 | |

|---|---|

Real Discount Rate | 4.20% |

Long-Term Inflation Assumption | 2.00% |

Nominal Discount Rate | 6.20% |

2017 | |

|---|---|

Real Discount Rate | 4.00% |

Long-Term Inflation Assumption | 2.00% |

Nominal Discount Rate | 6.00% |

2018 | |

|---|---|

Real Discount Rate | 4.00% |

Long-Term Inflation Assumption | 2.00% |

Nominal Discount Rate | 6.00% |

2019 | |

|---|---|

Real Discount Rate | 3.90% |

Long-Term Inflation Assumption | 2.00% |

Nominal Discount Rate | 5.90% |

2020 | |

|---|---|

Real Discount Rate | 3.85% |

Long-Term Inflation Assumption | 2.00% |

Nominal Discount Rate | 5.85% |

2021 | |

|---|---|

Real Discount Rate | 3.75% |

Long-Term Inflation Assumption | 2.00% |

Nominal Discount Rate | 5.75% |

2022 | |

|---|---|

Real Discount Rate | 3.75% |

Long-Term Inflation Assumption | 2.00% |

Nominal Discount Rate | 5.75% |

2023 | |

|---|---|

Real Discount Rate | 3.75% |

Long-Term Inflation Assumption | 2.00% |

Nominal Discount Rate | 5.75% |

2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | |

|---|---|---|---|---|---|---|---|---|---|---|

Real Discount Rate | 4.25% | 4.25% | 4.20% | 4.00% | 4.00% | 3.90% | 3.85% | 3.75% | 3.75% | 3.75% |

Long-Term Inflation Assumption | 2.25% | 2.00% | 2.00% | 2.00% | 2.00% | 2.00% | 2.00% | 2.00% | 2.00% | 2.00% |

Nominal Discount Rate | 6.50% | 6.25% | 6.20% | 6.00% | 6.00% | 5.90% | 5.85% | 5.75% | 5.75% | 5.75% |

The gap between the smoothed and fair value funded ratios will have a dampening impact on funding improvements in future years; however, the outlook for future returns has brightened due to the better interest rate environment and active shifts in our asset mix.

In 2023, the SC Board completed a Plan risk assessment that focused on the Plan’s long-term sustainability. The Board concluded there is a need to continue to build reserves as the Plan matures. No changes related to sustainability were made to contributions or benefits.

The Plan’s funded position has improved significantly from 86% in 2012 to 97% in 2023. The Plan is well positioned to build the reserves it needs if we achieve our expected future level of investment returns above inflation. As part of its ongoing responsibility, the SC Board will continue to monitor our funding progress and long-term sustainability.

For more information on the Plan’s financial health and associated risks, please refer to the Managing Plan Design and Funding Risks section in the MD&A in the Annual Report.

The SC conducts regular reviews to determine if benefit or contribution changes are required or appropriate due to an assessment of the long-term health of the Plan, changes in the pension environment or a desire to evolve the Plan to better meet the needs of our members and employers. In doing these reviews, the SC considers a wide range of potential outcomes with a view of appropriately balancing the needs of our diverse membership across generations.

OMERS maintains several significant investments in Canada’s infrastructure. A select few in 2023 include:

Beanfield Technologies, a 100% fibre infrastructure network servicing the enterprise, commercial and residential sectors, primarily in Toronto, Vancouver and Montreal.

Bruce Power, which provides 30% of Ontario’s energy and is OMERS single largest investment.

LifeLabs, providing laboratory testing services primarily in B.C. and Ontario to help healthcare providers diagnose, treat, monitor and prevent disease.

Porter, a Canadian airline headquartered at Billy Bishop Toronto City Airport on the Toronto Islands.

Teranet, the exclusive provider of systemically important electronic property search and registration services under long-term concessions in Ontario and Manitoba.

Our real estate portfolio includes some of Canada’s most desirable residential and office properties.

Our residential portfolio includes more than 6,000 units in Canada, providing long-term rental solutions and contributing to communities in Vancouver, Toronto, Brampton, Mississauga and Montreal.

The role of the workplace is more important than ever, and we have 15 million square feet of high-quality premium office space in Vancouver, Calgary and Toronto that help to enhance corporate culture and enrich employee experience.

Through our portfolio, our members have invested in some of Canada’s most recognizable names in entertainment, hotels and shopping malls.

An indirect stake in Maple Leaf Sports & Entertainment, the parent company of sports teams including the National Hockey League’s Toronto Maple Leafs, the National Basketball Association’s Toronto Raptors, Major League Soccer’s Toronto FC, and the Canadian Football League’s Toronto Argonauts.

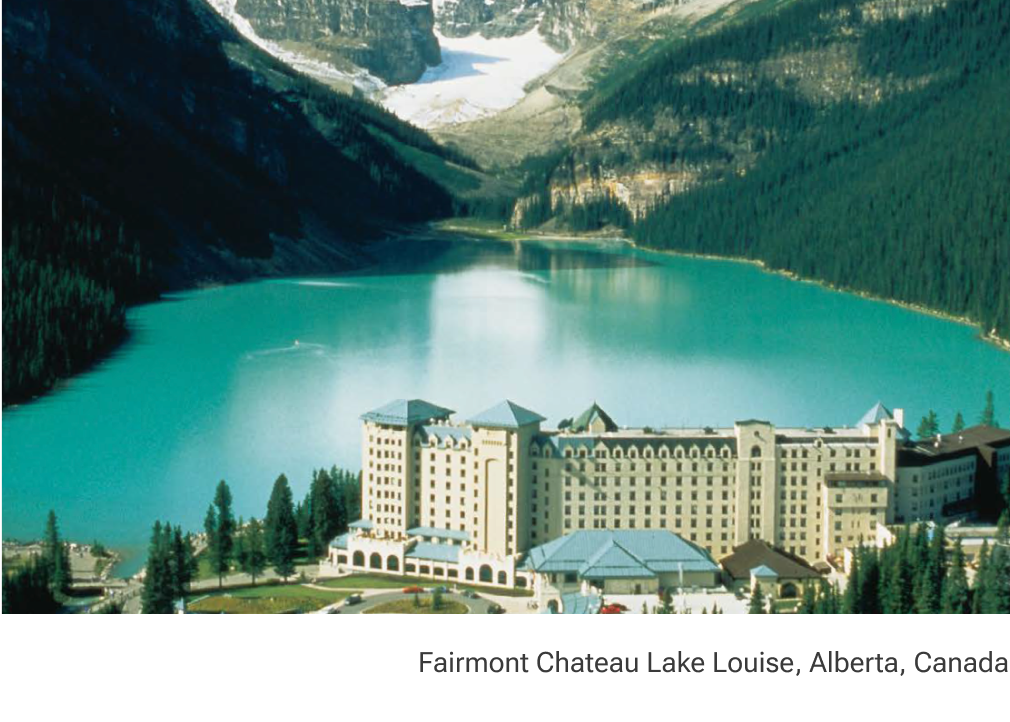

We invest in hotel properties across the country that provide more than 3,400 suites at storied resort hotels and best-in-class city properties, including InterContinental Toronto Centre and the redeveloped Park Hyatt Hotel in Toronto, the Fairmont Chateau Whistler in B.C., and Alberta’s premier portfolio of hotels including the Rimrock Resort Hotel and a trio of iconic Fairmont properties – the Banff Springs, the Chateau Lake Louise and the Jasper Park Lodge.

Our retail holdings include some of the country’s premium venues: Yorkdale Shopping Centre, Square One Shopping Centre, Hillcrest Mall, Upper Canada Mall and Scarborough Town Centre in Ontario, Les Galeries de la Capitale in Quebec and Southcentre Mall and Kingsway Mall in Alberta.

The Stack, Canada’s first new Zero Carbon Design standard certified commercial office tower – and Vancouver’s tallest commercial building

- Robert Bruins, Director,

Hotels, North American

Asset Management,

Oxford Properties, Toronto

We have invested in a portfolio of 70+ startup businesses, supporting entrepreneurs and innovative companies that are harnessing the power of technology to improve the lives of Canadians.

OMERS Ventures was the first pension plan early-stage direct investor in technology start-ups when we set up the program in 2011.

This is not a full list of our Canadian assets. For more on the investments held across the OMERS portfolio, please visit the Investing section of the OMERS website.

$13.7B

An increase of 14% since 2020

$3.8B

An increase of 14% since 2020

143,200

An increase of 19% since 2020

Almost a quarter of these jobs – more than 34,000 – are held by people under the age of 30

One-third of these jobs – approximately 48,000 – were based in rural regions

The Ontario Chamber of Commerce (OCC) named Mr. Hutcheson as the 2023 Lifetime Achievement Award Recipient. This award is presented annually to a person who has demonstrated outstanding leadership throughout their career and made a significant and positive impact on the province and beyond.

He was also named as one of the 25 appointees to the Order of Ontario. It is the province’s highest honour, celebrating people who have made exceptional contributions to helping build a strong province, nation and world. The appointment was announced January 1, 2024 by the Honourable Edith Dumont, Lieutenant Governor of Ontario and Chancellor of the Order of Ontario.

of ESG factors into investment decision-making

with like-minded institutions to amplify our voice

with portfolio companies to promote sustainable business practices

As an active, long-term investor, we work to understand how our investment activities affect the environmental, social and governance (ESG) systems that, in turn, provide a stable foundation for our portfolio.

Climate change is one of the defining issues of our time. In 2021, OMERS made a commitment to achieve net-zero greenhouse gas emissions by 2050, building on an earlier commitment to reduce our portfolio’s intensity by 20% before 2025, using 2019 levels as a base. In 2023, we set a further goal to achieve a 50% reduction by 2030.

We are pleased to report a 52% carbon reduction, thereby currently surpassing our 2030 goal.

In 2023, we published a Climate Action Plan (CAP), which sets out in more detail our approach to achieving net-zero greenhouse gas emissions by 2050.

The CAP outlines further commitments which include:

Growing our green investments to $30 billion by 2030;

Creating a $3 billion transition sleeve enabling investment in high carbon assets in need of funding for targeted decarbonization;

Engaging with the 20 highest emitters in our portfolio to establish credible net-zero transition plans by 2030;

Collaborating for change to evolve tools and standards required to better assess climate risk and opportunity, and;

Setting a net-zero commitment for our own internal operations, in alignment with our portfolio goals.

- Souvik Saha, Director, Investments, Oxford Properties, Singapore

The CAP can be found here, and further information on OMERS investing businesses and their sustainable investing progress can be found in the MD&A section of the full Annual Report.

We are an active voice on important investment industry initiatives and align our actions with relevant global best practices. In 2023, OMERS participated in national and global initiatives and alliances that enable us both to contribute to the conversation and to learn from the experiences of others. Notable examples include collaborating with our peers at the Investor Leadership Network to expand investors’ toolkits on climate and diversity, and speaking at COP28, a climate change conference hosted by the United Nations to advance climate action. In addition to being a founding member of Climate Engagement Canada, we bolstered our engagement strategy by joining Climate Action 100+. We also added our advocacy voice in key policy conversations this year focusing on sustainability disclosure standards via the International Sustainability Standards Board (ISSB) and board diversity practices with the Canadian Securities Administrators.

On broader ESG matters, we updated our Inclusion and Diversity Statement to highlight OMERS commitment to advancing the principles of Indigenous Reconciliation as set forth in Call to Action 92 of the Truth and Reconciliation Commission of Canada.

OMERS has established a Procurement-ESG program, using a scorecard to rank potential suppliers through a competitive process. This information helps decision makers consider ESG factors in their choices, as we seek to partner with sustainability-driven organizations.

Across Canada, there are now more people over the age of 65 than under the age of 14, and by 2030, one in six people will be over the age of 60 worldwide. These numbers reinforce our purpose at OMERS, where members are at the core of everything we do and where we are committed to being a trusted partner for them, from hire to retire – and beyond. We have a multi-generational and diverse membership. Our oldest member is 108 years old; our youngest member is 14. Our Plan provides value to those members, their employers, our sponsors, associations and unions. It provides an important direct benefit through pension payments, and multiple economic and social benefits to individuals and communities across Ontario.

In 2023, OMERS implemented a Plan change passed in 2020 that provided non-full-time employees the option to join the Plan. This resulted in us welcoming almost 45,000 new non full-time employees who chose this option. This speaks to the importance that employees place on having a workplace pension, and we thank these members and their employers for the confidence they have shown in us.

We improved the user experience of myOMERS, while strengthening its security through multi-factor authentication and enabling more 24/7 self-service functionality to provide members with greater convenience.

We are finding new ways to interact with members – which now includes our webinars, in-person regional sessions, member experience contact centre, live chat and secure communications.

We improved our Employer Support services, including the ability for employers to schedule a call with a pension administration expert, and made it easier for them to transact with us through our employer platform, e-access.

2023 marked the third year of the President’s Roadshow, which brings together OMERS leaders and members from diverse employers across the province. This year, we sat down with representatives from a First Nation, school boards, municipalities, fire services, a family and child services organization and a performing arts group.

We sincerely thank the members and employers who participated for their time and for sharing their thoughts with us. We look forward to meeting with more members in 2024!

- Jordanna DiBenedetto, Manager,

Pensions, Toronto

We updated and redesigned our active member statement as a Pension Report to empower members to make better decisions about their pension. We listened to member feedback and created more concise statements with clear language and reorganized content, to improve readability and understanding.

We made it easier for members to buy back service by offering extended payment plans.

We launched The Pension Blueprint, a podcast that establishes a modern medium to share educational content about the Plan, helping members learn more about their pension and kick-start their retirement planning. The podcast debuted on Spotify’s Weekly Top 20 and has been streamed 20,000+ times on Spotify and Apple Podcasts.

We launched an Employer Listening Tour to meet with employers across the province, looking for feedback on how we can better support them. We also introduced an employer survey and were pleased to hear from more than 300 administrators representing 200 employer groups. Following the survey, we hosted a feedback workshop with 54 employer administrators to keep the conversation going. Both the survey and the workshop provided us with significant insights that will enable us to advance employer services.

We implemented important changes in our employer platform – e-access – to improve efficiency, introducing batch enrolment so that employers no longer have to enrol each new non-full-time employee one at a time.

As pensions play an increasingly important role in our social infrastructure, we are leading a conversation about the future of retirement based on research and the experience of our members, thinking about how to reframe retirement and pension services for the future. With new research by the National Institute on Ageing further demonstrating the importance of secure, stable and adequate retirement income for healthy outcomes in older age, and member feedback that the pension is one of the factors in their decision to stay with their employer, these conversations are vital, and we are dedicated to pushing them forward.

147,330

Member phone calls

28,332

Secure communication messages

5,190

Live chats

1,752

Member webinars/education

199,520

Number of retired members at December 31, 2023

70,780

New enrolments in 2023

44,462

New non-full-time employees welcomed to the Plan in 2023

We are proud to work on behalf of our members and employers who keep our communities safe, clean and healthy, enhancing the quality of life of those who call them home.

We strive to provide an environment where employees – connected by our values of inclusion, integrity, humility and excellence – have a sense of belonging, are able to make an impact, and feel empowered to bring new ideas, fresh thinking and differing perspectives forward to build an even stronger workforce and culture.

Our work is grounded in delivering our People Strategy with a focus on inclusion and diversity, growth and development, and wellness.

Our ability to attract and retain top-tier talent is crucial in our ability to achieve the ambitious strategic goals that we have set on behalf of our members.

We appreciate that others have recognized the progress we have made towards being a leading employer, and have earned numerous accolades and awards in 2023.

Our Global Employee Experience Survey responses tell us that we are on the right track, reporting an overall engagement score of 82% (4% points above best-in-class) and a 93% participation rate (compared to best-in-class of 80%).

94%

are proud to work for OMERS and Oxford (+6% points above best-in-class)

89%

agree that our workplace is inclusive (+4% points above best-in-class)

88%

feel they can be themselves at work (+3% points above best-in-class)

88%

would recommend us as a great place to work (+6% points above best-in-class)

Please see the Careers page for more information on our culture and our team.

OMERS members dedicate their careers to Ontario’s communities. In the spirit of their public service, OMERS employees globally dedicate time and resources over the course of the year volunteering and supporting great causes. In December, one of our most popular initiatives is a month-long campaign where we ask ourselves, “What if each of us did just One Good Thing?” From bake sales to clothing drives, fundraisers to blood donations, the results made the end of the year a bit warmer for everyone.

- Kenton Bradbury, Executive Vice President, Head of Total Portfolio Management, Toronto

Every year, OMERS hosts a powerful speakers’ event featuring employees sharing stories and experiences that challenge, provoke and entertain. Among this year’s topics were race and inclusion, truth and reconciliation, AI and the force of technology and the battle against imposter syndrome.

In 2023, we continued to deliver our very successful Women in Leadership program, an award-winning, intensive experiential initiative for top talent. Since introducing it in 2020, we have had 59 women graduate from the program. 90% of their people leaders surveyed have assessed the participants as better ready for their next promotion; and 51% have been promoted during or shortly after the program.

49%

of total global workforce

31%

Women VP+

33%

Executive Leadership Team

31%

Investment professionals

On June 1, 2023, Deb Barnes

became OMERS Chief Risk

Officer. Deb joined OMERS in

2020 after an accomplished

career at Queensland Investment

Corporation in Australia. As the

head of the Risk function at

OMERS, Deb ensures that we

maintain a laser-sharp focus on

the risks that matter to the Plan.

“We are evolving how we think

about risk to facilitate very open

and deliberate conversations that

enable risks to surface so that

we can take the right steps to

address them.”

After more than a decade at OMERS, Ralph Berg became Chief Investment Officer on April 1, 2023. In this role, he is responsible for the global strategy across the Plan’s investment activities. His career includes more than 25 years of broad investment industry experience. This includes seeing our Infrastructure business through a period of global expansion and navigating the challenges and opportunities of a volatile economic cycle while heading the Capital Markets group.

“I am proud of our accomplishments in service of our Plan members and look forward to continuing to capitalize on the vast opportunities that lie ahead.”

Effective January 1, 2024, Celine Chiovitti became OMERS Chief Pension Officer. Celine joined OMERS in 2013 after a career in municipal public service. As the Chief Pension Officer, Celine and her team are responsible for administering pensions and meeting the needs of our diverse members, employers, sponsors and stakeholders.

“We are united by our Pension Promise to deliver a sustainable, affordable and meaningful plan, providing secure retirement income for generations to come – and I am excited to continue down our path to evolve and modernize the retirement experience.”

OMERS members, employers, sponsors and stakeholders are integral to our community. We are deeply committed to engaging with you regularly to share information and partner on areas of mutual interest. We invite you to join us at OMERS Annual Meeting, a hybrid event taking place on Wednesday, April 3, 2024 in-person at the Metro Toronto Convention Centre with simultaneous webcast. The meeting will begin at 9:00 AM EDT.